Lee Adler posted....

Despite the new highs and the great growth and yada yada yada ....we are on the brink of a

recession. I have the numbers to prove it. And the numbers don't lie. Data on Federal tax

collections comes to us in real time every day, courtesy of the US Treasury. This is

unmassaged real data, not the endlessly finagled economic data put out by various other

US government agencies. Tracking the tax data regularly enables us to see how the US

economy is actually behaving, versus how the government wants you to think it's behaving.

That's important because the current data tells us something really big about the US

economy that nobody knows yet. It won't show up in the official GDP data for months, but

it could rock the markets and cause the Fed to change course. Here's the big news.

- 51960.JPG (49 KiB) Viewed 5699 times

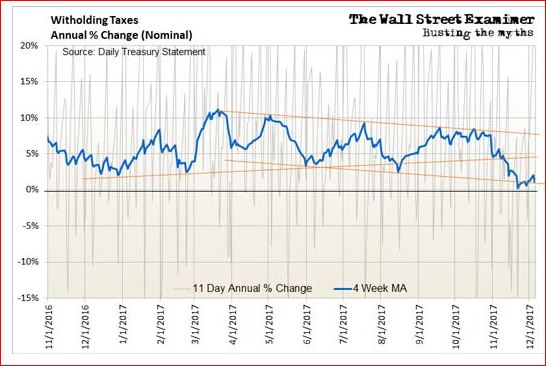

Withholding tax collections plunged in the second half of November, suggesting that the

US is on the brink of, if not entering, recession. The drop in withholding not only broke

a yearlong uptrend, but it has established a downtrend. After adjusting for wage inflation,

the year to year comparison is now slightly negative. It means that the US is barely hanging

above recession. It will take a couple of months more before we know for sure one way or

the other, depending on how strong or weak collections are. Officially it takes 2 quarters

in a row of falling GDP for the NBER to call a recession. By the time that second GDP report

comes out, months after the tax data has already tipped us off, the recession will have

already been under way for 7-9 months. But the Fed wouldn't materially loosen policy until

then. There's no guarantee that the numbers will go negative in the short run. Consequently,

we should not expect any loosening of policy until at least late 2018. That's plenty of time

for tight monetary policy, euphemistically named "normalization," to cause considerable

damage to stock prices. The Fed started real tightening in October. It has begun to shrink

its balance sheet. That will pull money out of the banking system. The program is starting

very gradually, with only baby steps that are barely impacting the markets. But over time

it will increasingly drain money from the pool of cash available to purchase stocks and bonds.

This has set up the conditions for a bearish stock market, but as I have been emphasizing,

it won't necessarily trigger them immediately. As you know if you have been following along

with these reports, we've been looking to January-February as the likely window for a market

high. Because the tax data is real time hard data, it gives us an edge. Economic data is

lagged and manipulated. It often takes another month, or several months, before the economic

data reflects what the tax data has already shown. With the benefit of knowing what the tax

data tells us about the actual state of the economy, we can move in advance of the crowd.

We can more easily identify the false narrative, or at least the old narrative that is no

longer true. The strength in the tax data prior to November told us that the economy was

heating up. That told us that the Fed would tighten. These cycles tend to last a few years.

During that time the Fed has difficulty because the economy defies conventional wisdom and

continues to heat up as interest rates rise. Bear markets thrive in these environments. Each

time the market sells off, the bottom is declared and dip buyers come in. But the ensuing

rally falls short of the last one and the market rolls over again. Early in the cycle the

opportunity usually presents itself to place judicious short positions on both individual

industries and the broad market. I give suggestions for those based on technical analysis

in the Wall Street Examiner Pro Trader Daily Trades List.

- 51636.JPG (79.78 KiB) Viewed 5699 times

Total withholding tax collections are available to us virtually in real time in the US

Treasury's Daily Treasury Statements, released with just a one day lag, which makes them

an excellent analytical resource. However, they are extremely volatile day to day so I

rely more on a monthly moving average of the 11 day total collections, comparing that

with the prior year. Smoothing sacrifices a bit of timeliness to get a clearer picture

of the trend without losing too much of the edge that the daily data provides. Unfortunately,

I have found even the 11 day total data too noisy for meaningful comparison so I've had

to resort to additional smoothing. As a result the smoothed data is a little slow, so I

also look at raw data trends to get a better sense of timing. Withholding tax collections

are now signaling that the US economy is on the cusp of possible recession. The annual

growth rate slipped to +2.2% as of December 5. That's before inflation. Average weekly

earnings have lately been growing at somewhat north of 2.5% (but there's no inflation,

ahem). So applying a 2.5% wage inflation factor indicates that real growth is now slightly

negative.

Do that 2 quarters in a row and it would be an official recession. The Fed wouldn't loosen

policy until at least then and possibly later. Furthermore, there's no guarantee that the

numbers will go negative in the short run. Consequently we should not expect any loosening

of liquidity probably until at least October, and maybe later. This weakening in withholding

tax collections followed 2 very strong months in September-October where they were gaining

around 8-9% on a year to year basis. At the same time, we were seeing canaries in the coal

mine in other tax series, particularly excise taxes, that told us that there was something

rotten going on. This supports one of my pet sayings. "Employers are always the last to get

the news"-along with investors! The big gains over the summer were probably more about huge

gains in withholding from those at the very top of the income spectrum, and not about broad

based recovery. Big percentage gains by those earning millions skew the topline totals to

obscure weak gains, if any, in the middle of the spectrum.

That's bearish because it keeps the Fed on its tightening course. Markets top out when the

economic news is good because that's when central banks pull the punchbowl. That process

is under way again. We already know what the outcome will be. It is only a matter of time.